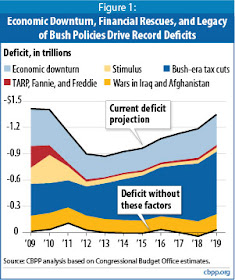

In prior posts, I posited that the Bush Tax Cuts and the bank bailouts (especially through the Fannie/Freddie bailouts) accounted for large portions of the current debt nightmare facing the US. The graph at left depicts the relative contributors to the US deficit and hence our debt problem. Obviously, the Bush Tax Cuts loom large over time. But, the next largest contributor is the Bush economic downturn.

In prior posts, I posited that the Bush Tax Cuts and the bank bailouts (especially through the Fannie/Freddie bailouts) accounted for large portions of the current debt nightmare facing the US. The graph at left depicts the relative contributors to the US deficit and hence our debt problem. Obviously, the Bush Tax Cuts loom large over time. But, the next largest contributor is the Bush economic downturn.

To be fair, not all of the downturn can be attributed to the policies of the Bush Administration. The Clinton Administration pursued financial deregulation too, particularly through the repeal of Glass-Steagall. And, as I have argued since December of 2008, the Obama Administration failed to pursue adequate fiscal stimulus and failed to design its inadequate stimulus in an economically rational way, in particular relying upon tax cuts that would be saved by consumers and hoarded by the financial system rather than stimulating growth. Nevertheless, the Bush Administration's economic policy boiled down to just cutting taxes again and again and the evidence is conclusive that those tax cuts failed to stimulate sustainable growth.

Thus, according to former Reagan and Bush I Administration official Bruce Bartlett :

"It would have been one thing if the Bush tax cuts had at least bought the country a higher rate of economic growth, even temporarily. They did not. Real G.D.P. growth peaked at just 3.6 percent in 2004 before fading rapidly. Even before the crisis hit, real G.D.P. was growing less than 2 percent a year. . . .Real G.D.P. growth was 4.1 percent in 1994 despite widespread predictions by opponents of the 1993 tax increase that it would bring on another recession. Real growth averaged 4 percent for the balance of the 1990s. By contrast, real G.D.P. growth in the nonrecession years of the 2000s averaged just 2.7 percent a year — barely above the postwar average."

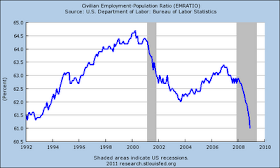

And, in terms of jobs, the Bush Administration holds a deplorable record, as demonstrated here:

Over eight years, from 2000 to 2008, employment in the US plunged, wiping out all of the robust job growth of the Clinton years of 1992-2000. The Bush Administration ushered in a lost decade of employment stagnation even before the recession hit. Those job losses translate into more debt for strapped households, more loan defaults, lost tax revenues and, ultimately, failed economic policies for the Bush Administration.

Over eight years, from 2000 to 2008, employment in the US plunged, wiping out all of the robust job growth of the Clinton years of 1992-2000. The Bush Administration ushered in a lost decade of employment stagnation even before the recession hit. Those job losses translate into more debt for strapped households, more loan defaults, lost tax revenues and, ultimately, failed economic policies for the Bush Administration.

These failed economic policies form the foundation of the financial crisis which was triggered by too much consumer debt and not enough consumer income--i.e., a very weak job market notwithstanding (or perhaps because of) the very wasteful Bush Tax Cuts. This is the third part of our debt nightmare rooted in failed GOP policies.

"In prior posts, I posited that the Bush Tax Cuts and the bank bailouts (especially through the Fannie/Freddie bailouts) accounted for large portions of the current debt nightmare facing the US."

ReplyDeleteWhile you are right about Fannie and Freddie (I'm glad to see that you've come around) you were and are completely wrong about the Bush "tax cuts". From the WSJ:

"Many blame the Bush tax cuts for adversely impacting federal revenues, causing the debt to spiral upwards. But that is just not true. Federal revenues declined by almost 12% in the early years of the decade, but when the tax cuts fully kicked in in 2003, the economy began to grow strongly again and federal revenues increased 44% in the next four years, while unemployment fell to 4.2% from 6.2%. Federal outlays in those four years increased by only 26.4%, and while the debt-to-GDP ratio increased to 64.8% by 2007, that was still well below what it had been in 1994."

And the Washington Times:

"... the real jolt for tax-cutting opponents was that the 03 Bush tax cuts also generated a massive increase in federal tax receipts. From 2004 to 2007, federal tax revenues increased by $785 billion, the largest four-year increase in American history. According to the Treasury Department, individual and corporate income tax receipts were up 40 percent in the three years following the Bush tax cuts. And (bonus) the rich paid an even higher percentage of the total tax burden than they had at any time in at least the previous 40 years. This was news to the New York Times, whose astonished editorial board could only describe the gains as a “surprise windfall.”

Contrary to the predictions of most left-wing economists, tax receipts increased dramatically following the Bush "tax cuts". Increased tax revenues do not contribute to deficits and by extension to the debt.

P.S. Maybe your could extend that chart on Bush's unemployment record all the way to the end of Obama's first and only term, that way you could claim that Bush is the one responsible for all of Obama's failures. At least that would be consistent with Democrat party talking points.

And how much of this imaginary tax windfall went to paying off 2 wars.......

DeleteZERO

Quote:

The Bankruptcy Boom

In breathtaking disregard for the most basic rules of fiscal propriety, the administration continued to cut taxes even as it undertook expensive new spending programs and embarked on a financially ruinous “war of choice” in Iraq. A budget surplus of 2.4 percent of gross domestic product (G.D.P.), which greeted Bush as he took office, turned into a deficit of 3.6 percent in the space of four years. The United States had not experienced a turnaround of this magnitude since the global crisis of World War II.

Agricultural subsidies were doubled between 2002 and 2005. Tax expenditures—the vast system of subsidies and preferences hidden in the tax code—increased more than a quarter. Tax breaks for the president’s friends in the oil-and-gas industry increased by billions and billions of dollars. Yes, in the five years after 9/11, defense expenditures did increase (by some 70 percent), though much of the growth wasn’t helping to fight the War on Terror at all, but was being lost or outsourced in failed missions in Iraq. Meanwhile, other funds continued to be spent on the usual high-tech gimcrackery—weapons that don’t work, for enemies we don’t have. In a nutshell, money was being spent everyplace except where it was needed. During these past seven years the percentage of G.D.P. spent on research and development outside defense and health has fallen. Little has been done about our decaying infrastructure—be it levees in New Orleans or bridges in Minneapolis. Coping with most of the damage will fall to the next occupant of the White House...

Although it railed against entitlement programs for the needy, the administration enacted the largest increase in entitlements in four decades—the poorly designed Medicare prescription-drug benefit, intended as both an election-season bribe and a sop to the pharmaceutical industry. As internal documents later revealed, the true cost of the measure was hidden from Congress. Meanwhile, the pharmaceutical companies received special favors. To access the new benefits, elderly patients couldn’t opt to buy cheaper medications from Canada or other countries. The law also prohibited the U.S. government, the largest single buyer of prescription drugs, from negotiating with drug manufacturers to keep costs down. As a result, American consumers pay far more for medications than people elsewhere in the developed world...........

http://www.vanityfair.com/politics/features/2007/12/bush200712

WSJ be darned.. .

Seems th WSJ pretty much stands alone....

ReplyDeleteIt’s hard even to find Republican economists who will defend Bush’s policies. Summing up the Bush years, Douglas Holtz-Eakin, who was chief economist for the Council of Economic Advisers in Bush’s first term, had this to say in an interview with the Washington Post at the end of the Bush administration:

The expansion was a continuation of the way the U.S. has grown for too long, which was a consumer-led expansion that was heavily concentrated in housing. There was very little of the kind of saving and export-led growth that would be more sustainable. For a group that claims it wants to be judged by history, there is no evidence on the economic policy front that that was the view. It was all Band-Aids.

Harvard economist Dale Jorgenson, who is highly respected by supply-siders, put it more succinctly. When asked by The New York Times last year to name some positive aspects of Bush’s economic policies, he replied, “I don’t see any redeeming features, unfortunately.”

http://www.thefiscaltimes.com/Columns/2010/09/17/Bush-Tax-Cuts-No-Economic-Help.aspx#page1