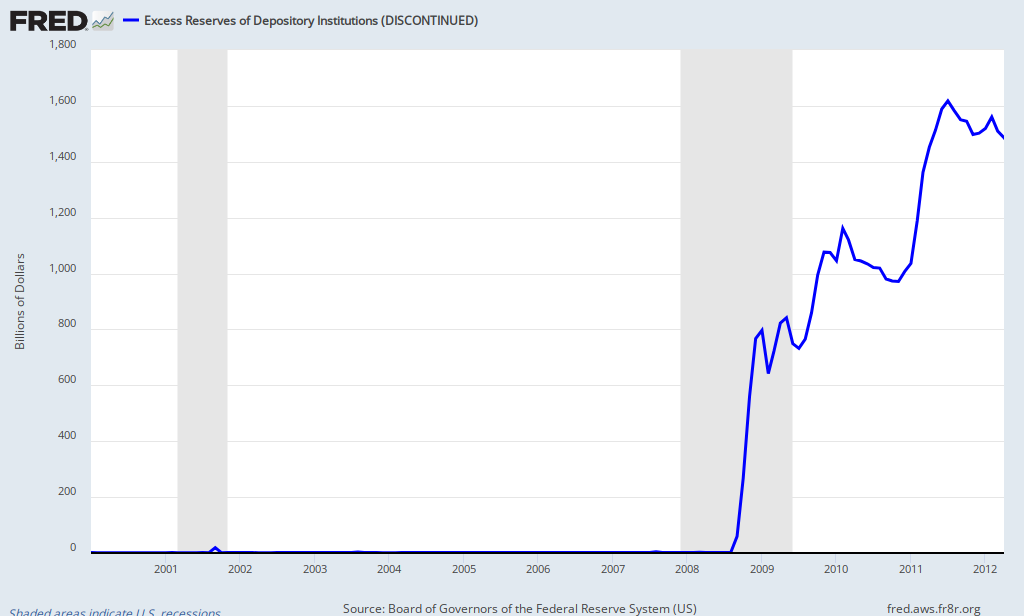

The chart above, which repeatedly has been in focus on this blog (most recently by dre cummings), shows that our banks continue to hoard vast wealth that could fund massive economic growth through new loans or through alternative government programs other than massive subsidies for the megabanks. Two factors basically drive the banks to accumulate reserves rather than lend: severe risk aversion and the ill-advised decision by the Fed to pay interest on reserves for the first time in October of 2008--thus, putting a decidedly contractionary influence upon monetary policy at the onset of a major downturn.

This new program also represents a massive transfer of money to the banks from the government. The Fed pays about .25 percent to encourage banks to hold reserves. During that same period the equivalent investment in Treasury obligations would have essentially zero yield. Basically, over four years we gave the banks about $100 billion for not investing the vast wealth that we pumped into the financial sector to keep it afloat after the financial crisis caused by the obscene recklessness of the banks. This constitutes the worst corporate welfare program in our history, for it is at once the most economically counterproductive and morally reprehensible use of social wealth imaginable. It is in short, a reflection of a banktatorship.

On May 31, I flew to Spain. Spain is today ground zero in the financial crisis and I wanted to see first hand how Spaniards are coping and what they think about the bank crisis. Just like the US, Spain is quickly shedding social programs and stunting its economic growth in order to turn the nation state into a giant bank welfare state. Thus, for example, Spain has dramatically cut coal subsidies resulting in thousands of lost jobs in the coal sector despite the fact the nation already has a 25 percent unemployment rate. At the same time, Spain is poised to inject nearly $25 billion into one of its largest banks, and the IMF suggests a total of at least $50 billion will ultimately be needed.

The economic carnage in Spain and Greece is a warning to America. Austerity for everyone but the banks is a cruel and suicidal policy. No economy can function when the state becomes an appendage of big finance. The only winners are senior bank executives and their cronies in government. Who would invest in such a pseudo-capitalist society? If banks suck all of the oxygen out of an economy who will buy any good and services produced? The brewing Euro-depression stands as a stark reminder to America that giving all social wealth to a small handful of banking elites (a policy that originated in America with the repeal of Glass-Steagall) will destroy an economy and lead to mass impoverishment.

The megabanks must be broken up and this remains the biggest issue of the coming political campaign--which likely will not even be on the table given the bi-partisan nature of the American banktatorship.

No comments:

Post a Comment