These developments mean that some ill-defined class of powerful corporate elites may engage in criminality for profit with immunity from prosecution. If one of these titans can garner millions through some fraudulent scheme (like this one used at Goldman, Chase, and Citi) they will now face incentives to do so regardless of losses of many times their profits borne by their firms (like this securities fraud by Angelo Mozilo), investors, or the general economy.

So what is the cost of this new government policy of criminal immunity for those that control trillions in economic wealth? Finding the answer to that question is difficult, particularly looking into future of an unprecedented era of lawlessness.

Nevertheless, we do have one important experience--the cost of the subprime debacle. I wrote in Lawless Capitalism that the core cause of the crisis was the power of corporate and financial elites to dominate the law and rig market outcomes. That level of lawlessness is one notch less noxious than the leak to the New York Times on 12/11/12 that elites at megabanks now enjoy near-express criminal immunity for even grand criminality.

So, what were the costs of the subprime debacle? It can be broken into three categories that comprehensively express the costs. First, the costs in terms of forgone GDP. Second, the increased debt incurred by the government as a result of the crisis. Third, the loss in household net worth during the crisis. By any reckoning the cost amounts to trillions in losses, but let me try to roughly calculate how many trillions we are talking about.

1. FORGONE GDP

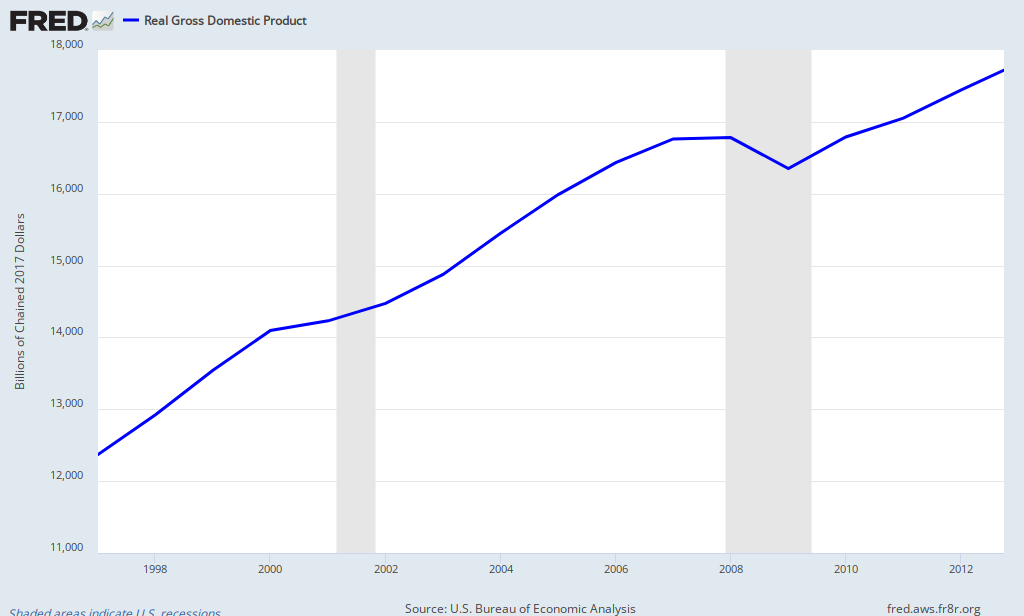

The graph below, from the Federal Reserve Bank of St. Louis, shows real GDP since 1997:

Clearly, the crisis of 2007-2009 triggered an irreversible loss of GDP that still has not been halted by a return to prior trend-line growth. Thus, the costs still mount. Nevertheless, real GDP trended towards $14 trillion prior to the crisis and would have reached that point in 2010. Actual real GDP in 2012 still amounted to only $13.59 trillion--at least $410 billion short. 2011 came up at least $680 billion short, and 2010 came up $750 billion short. Those three years total $1.84 trillion in forgone real GDP (2005 dollars). The most brutal years of GDP contraction were 2008 and 2009. To be conservative, those years should be compared to 2007, and real GDP losses total another $450 billion during those two years. In all, it appears that a rough estimate of lost real GDP today totals at least $2.3 trillion (and counting). This number is consistent with economists' analyses suggesting that severe crises such as the subprime debacle lead to output losses of about 25-30 percent of GDP--or about $3.2 trillion in the case of the US.

Clearly, the crisis of 2007-2009 triggered an irreversible loss of GDP that still has not been halted by a return to prior trend-line growth. Thus, the costs still mount. Nevertheless, real GDP trended towards $14 trillion prior to the crisis and would have reached that point in 2010. Actual real GDP in 2012 still amounted to only $13.59 trillion--at least $410 billion short. 2011 came up at least $680 billion short, and 2010 came up $750 billion short. Those three years total $1.84 trillion in forgone real GDP (2005 dollars). The most brutal years of GDP contraction were 2008 and 2009. To be conservative, those years should be compared to 2007, and real GDP losses total another $450 billion during those two years. In all, it appears that a rough estimate of lost real GDP today totals at least $2.3 trillion (and counting). This number is consistent with economists' analyses suggesting that severe crises such as the subprime debacle lead to output losses of about 25-30 percent of GDP--or about $3.2 trillion in the case of the US. 2. MORE GOVERNMENT DEBT

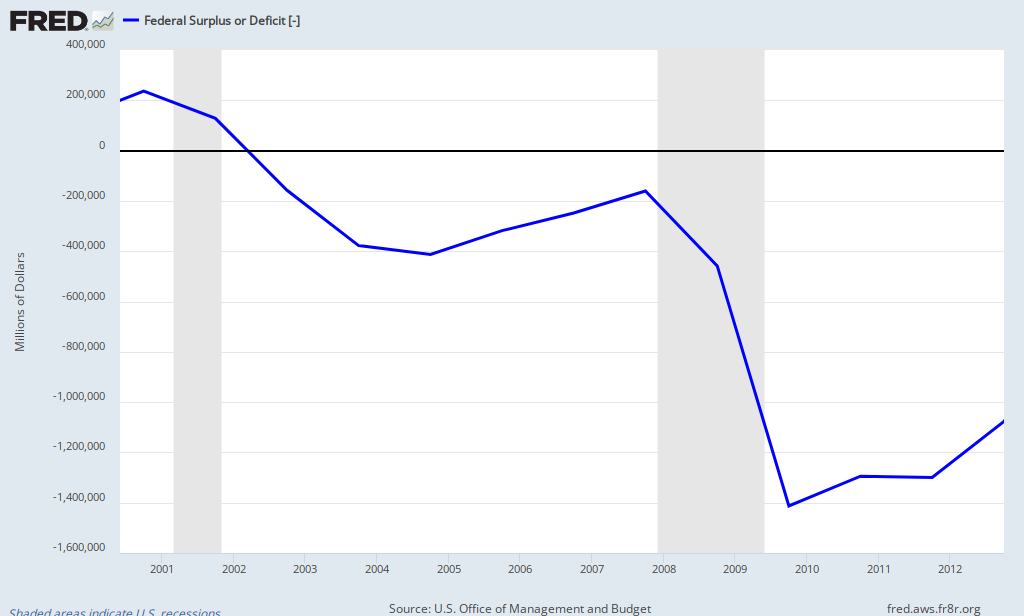

As the chart, left, shows, the federal deficit increased dramatically as a result of the subprime debacle, and has not recovered. The Bush tax cuts of 2001-2003 (and unfunded wars) built-in structural deficits of about $300 billion per annum. Still, since 2008, additional deficits of trillions of dollars piled-on to those structural deficits. In 2008, the deficit was $459 billion; it expanded to $1.4 trillion in 2009; and most recently in 2012 narrowed to $1 trillion. So, the national debt stood at $9 trillion at the end of 2007 and today stands at $16 trillion. At least $5 trillion of this additional debt is directly attributable to the financial crisis whether from constricted revenues from forgone GDP, the stimulus bill or various and sundry bailouts. These deficits are the cost of a financial crisis requiring a government response without precedent.

As the chart, left, shows, the federal deficit increased dramatically as a result of the subprime debacle, and has not recovered. The Bush tax cuts of 2001-2003 (and unfunded wars) built-in structural deficits of about $300 billion per annum. Still, since 2008, additional deficits of trillions of dollars piled-on to those structural deficits. In 2008, the deficit was $459 billion; it expanded to $1.4 trillion in 2009; and most recently in 2012 narrowed to $1 trillion. So, the national debt stood at $9 trillion at the end of 2007 and today stands at $16 trillion. At least $5 trillion of this additional debt is directly attributable to the financial crisis whether from constricted revenues from forgone GDP, the stimulus bill or various and sundry bailouts. These deficits are the cost of a financial crisis requiring a government response without precedent. 3. LOST HOUSEHOLD WEALTH

Recently, a group of Federal Reserve economists estimated the loss to household net worth arising from the subprime crisis of 2007-2009. They found that the mean loss to household wealth was $114,000 per family for those two years. It is unclear how many families there are in the US, but the Census Bureau counts about 110 households. Multiplying the mean loss by the number of households yields a total loss to household net worth of $12 trillion.

That number seemed high until I found this line from the President's Budget Message in 2010: "household net worth fell from the third quarter of 2007 to the first quarter of 2009 by $17.5 trillion or 26.5 percent, which is the equivalent to more than one year’s GDP." Thus, the peak net worth loss was $17.5 trillion but as markets recovered in late 2009, it moderated a bit to that $12 trillion number.

But that $12 trillion is more durable. Housing, which forms the basis of most American net worth still has not recovered. Further, the S&P 500 has still not reclaimed its its peak in 2007--especially adjusted for inflation. And, in real terms recent gains in net worth are far less impressive. In sum net worth too is still well below the long term pre-crisis trend.

Based upon the foregoing, Lawless Capitalism is enormously expensive. The crisis cost Americans at least $15-20 trillion in economic costs. The fact that some of the costs have been placed upon the government or is in the form of lost net worth does not mitigate the ultimate economic pain associated with the crisis. We now have a government that will have to do less and tax more far into the future. Households have less money for college, retirement, and future consumption. These factors will continue to burden real GDP growth for years to come.

There are other costs to Lawless Capitalism. For example, consider what many call the "freeloader" society. We cannot expect the masses to bear the burden of shared sacrifice when those at the top in our society act so manifestly contrary to any notion of responsible and ethical leadership. Indeed, perhaps the greatest cost of lawless capitalism is impossible to quantify: a society riven with a selfish and unethical ethos of greed. How does one quantify the loss of social cohesion from lawlessness at the apex of society?

I am all ears if anyone can improve on the analysis above. But, in all events, this lawlessness costs every American tens of thousands of dollars. And, the new lawlessness continues at an ever increasing level, unmitigated by the Dodd-Frank Act.

Fascinating analysis, professor. Keep up the great work! Do you have any talks in Chicago coming up? I would love to attend!!!!!

ReplyDeleteI cringe at quoting alternet, (they are quite biased in my humble opinion) however, they are right on here: http://www.alternet.org/outrage-some-banks-are-too-big-prosecute?paging=off

ReplyDelete"The Justice Department believes that Too Big to Fail Banks are Too Big to Jail. Criminal indictments against banks or leading bankers might endanger the economy and thus were too big a risk."