It

is hard to overstate the impact of megabank derivatives trading on our

economy. Although three years after Dodd-Frank they remain a virtually

dark market, experts estimate that the derivatives market may now exceed $1.2 quadrillion. A Quadrillion has 15 zeros and looks like this: 1,000,000,000,000,000.

It

is hard to overstate the impact of megabank derivatives trading on our

economy. Although three years after Dodd-Frank they remain a virtually

dark market, experts estimate that the derivatives market may now exceed $1.2 quadrillion. A Quadrillion has 15 zeros and looks like this: 1,000,000,000,000,000.Another way of thinking about that huge number is that it amounts to 20 times the entire global economy. While that huge number is only the notional amount it still represents a huge commitment of the world's capital resources--perhaps as much as $10 to $20 trillion dollars. All this capital is committed to an enormous zero sum game that carries an enormous risk of blowing up the financial system as occurred in 2008. As Michael Sivy points out, even a small move either way in the value of the huge notional amount of derivatives would wipe-out even well-capitalized banks. The size of the market necessarily implies huge problems and risks.

First, I contend that much of the so-called "money printing" of the Federal Reserve is dedicated to to derivatives trading with nearly zero resulting credit expansion at the megabanks. Second, much of the trading is the direct result of accounting fraud--specifically the accounting rules allow both counterparties to the same trade to recognize gains and this allows the megabanks to pump up their earnings accordingly. Third, a huge percentage of the trading occurs only because the megabanks can sell their too big to fail status to counterparties which in turn encourages more risk throughout the economy. Fourth, derivatives trading is heavily subsidized by depositors who now stand behind derivatives counterparties if a megabank fails. Thus, the next financial crisis will demonstrate that derivatives still pose a lethal risk to the global economy.

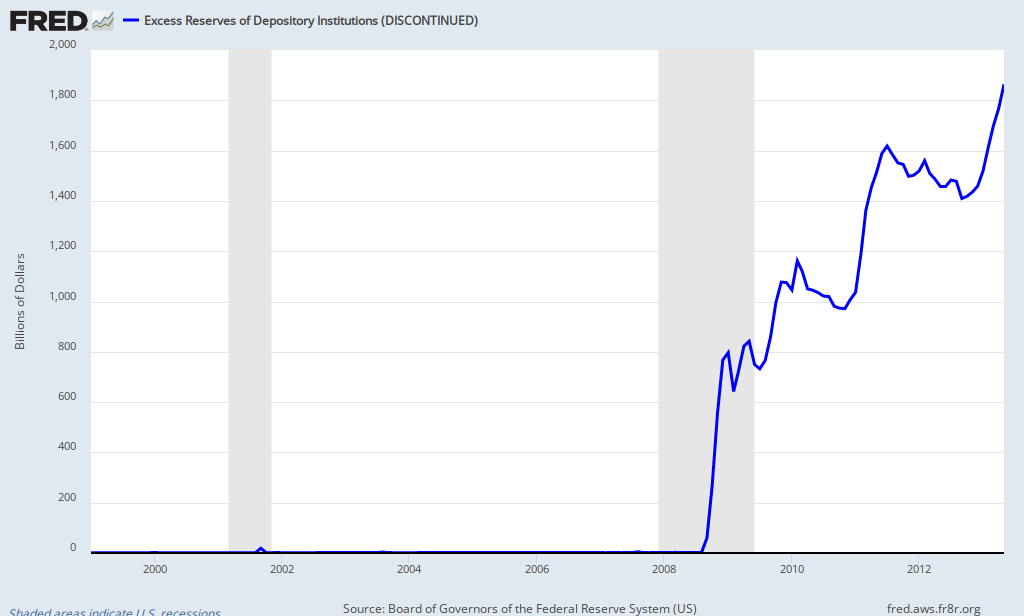

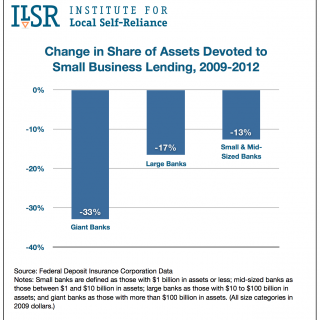

1) Fed and monetary policy. As demonstrated by the above chart, the monetary transmission is and has been broken. Banks are not lending. Everyone agrees that if bank lending proceeded apace the economy would be expanding. Instead the banking system hoards excess reserves that could be lent out. In the wake of the crisis, the megabanks cut small business loans lending at more than twice the rate of community banks, as reflected in the chart in the chart at right. Thus, despite massive excess reserve to lend, bank lending still has not recovered to the pre-crisis. On the other hand, excess reserves held at the Fed are an ideal form of collateral for derivatives transactions, as my friend Christian Johnson explains, here at p. 9. And, since the Fed pays interest on excess reserves of .25 percent (well over the market rate for short term Treasuries with high liquidity of essentially zero percent), the Fed is basically subsidizing the megabanks' collateral on derivatives to the tune of billions of dollars per annum. The precise extent of this subsidy is unknowable; but the total subsidy to all commercial banks totals $5 billion per annum (.0025 times $2 trillion in reserves). While the exact numbers are difficult to pin down it is obvious that derivative trading is squeezing out lending and the Fed facilitates this activity through its payment of above market interest rates for banks holding excess reserves. In fact, trading profits are the key driver of megabank earnings as evident here, here, here and here. Simply put huge amounts of derivatives trading are squeezing out lending at the cost of economic growth.

2) Derivatives and Accounting Manipulation. The megabanks hold a total of about $210 trillion dollars in derivatives, nearly all of which are not traded on transparent exchanges but instead are traded over the counter (OTC). Zero Hedge recently posted an illuminating blog entry on the business of derivatives trading and profit manipulation at the banks. According to Zero Hedge Bank of America's entire profit would have been wiped out under mark-to-market accounting. All of the bank's profit resulted from the mark-to-model accounting method permitted since 2009 when the FASB promulgated Staff Position 157-4. Trading of complex derivatives has always involved a subjective determination of "fair value." So subjective that both parties to a derivatives transaction can, in fact, claim profits on the same derivative transaction. In fact, after Lehman's bankruptcy collateral apparently was wildly up for grabs due to the vagaries of valuing derivatives positions. All of this means that while derivatives are technically a zero-sum game (negative sum when substantial transactions costs are included) the megabanks still profit mightily in this market because of imperfect accounting. Where else can two parties to a bi-lateral contract both claim profits?

3) Selling TBTF Status and Government Guarantees. The derivatives markets allows the megabanks to sell the full faith and credit of the US government. Indeed, one may wonder how much of the market would exist without the ability to sell government guarantees. After all, the main reason in favor of derivatives transactions is that allows the free flow of risk to those best able to bear it and those who desire it. There is little doubt that TBTF lives as argued on this blog on the date Dodd-Frank was signed-- the only question is the size of the subsidy (a question the FDIC recently tackled in this literature review). So the megabanks offer the ideal mechanism to shift risks: a default proof counterparty. This is why the top five megabanks control 95% of the derivatives market. Every derivatives counterparty wants a default proof counterparty. Further, the megabanks will under-price this government guarantee since they bear virtually no prospective cost of the guarantee at all. The corollary to this is that the entire economy takes on too much risk because the megabanks are in business to sell government guarantees to all buyers, and the banks will assume concentrated risk such as the JP Morgan London Whale trade that cost the megabank billions. This high risk trading can be more nefarious than initially appears. Perhaps the best proof of my point is the behavior of the megabanks themselves: when they suffered ratings downgrades they moved much of their derivatives business to their bank subsidiaries so that the trading would be backed by insured deposits.

4) The Death of Depositor Preference. After the Great Depression even governing elites accepted that bank runs constituted a lethal risk to capitalism. Sustainable credit is a key prop to growth. Yet, credit cannot expand to maximum sustainable levels without fractional reserve banking. If a community panics and runs on a bank then the bank must face failure or need to raise cash by pulling lines of credit and calling loans. The answer to this risk is deposit insurance. The FDIC effectively ended bank runs. Part of the effectiveness of deposit insurance is depositor preference regimes. Depositor preference means that the first claim (after administrative costs) on bank assets is depositors--even uninsured depositors. This bedrock principle of safe and sound deposit insurance diminishes incentives for even uninsured depositors to panic and withdraw their funds from banks. The megabanks derivatives activities have ended depositor preference by distorting law and regulation and giving first claim on megabank assets to derivatives counterparties. Specifically, as Mark Roe writes here (and the FDIC apparently concurs here):

"derivative counterparties unlike most other. . .creditors, can seize and immediately liquidate collateral, readily net out gains and losses in their dealings with the bankrupt, terminate their contracts with the bankrupt, and keep both preferential eve-of-bankruptcy payments and fraudulent conveyances they obtained from the debtor, all in ways that favor them over the bankrupt’s other creditors. Their right to jump to the head of the bankruptcy repayment line, in ways that even ordinary secured creditors cannot, weakens their incentives for market discipline in managing their dealings with the debtor because the rules reduce their concern for the risk of counterparty failure and bankruptcy."

Basically, this means that derivatives creditors get an FDIC super-priority that no other bank creditor gets--not even a depositor. This super priority risks bank runs by large uninsured depositors who will justifiably flee the megabanks at the first sign of trouble. What will remain of a bank's assets once the derivatives creditors have grabbed all the collateral for their derivative claims?

All of the four above points show that derivatives exist largely as a function of government indulgences and subsidies that have nearly zero legitimate policy bases. It is yet another testament of the triumph of power over policy.

This is utter foolishness as it ignores basic financial history, further subsidizes zero sum transactions that threaten financial stability, and places the economic interests of a handful of financial elites above 300 million Americans and the entire global economy.

In fact, I can think of nothing positive to say about the legal and regulatory frameworks applicable today to derivatives and TBTF banks, as I previously argued, here, here, here, here, and here.

Excellent article and summary. Thanks!

ReplyDeleteI knew most of this, but had not put it all together so succinctly. And had not yet realized the consequences derivatives creditors' super priority.

I have never quite understood why people might feel secure with the FDIC insuring bank deposits in case of an economic collapse.

ReplyDeleteIt is my understanding that FDIC has 15 years to pay out.

What kind of insurance is that?

Calm

As a former FDIC Senior Attorney, I actually participated in the take-down of many insured institutions. We would walk in on Friday afternoon, relieve management, and post a sign stating that full and unlimited deposit access would continue uninterrupted for up to the insured amount. The next day, Saturday, the bank would continue all operations uninterrupted, under FDIC supervision.

ReplyDeleteI have studied the FDIC Act and regulations thereunder in depth for over 23 years. I have no idea where your 15 year number comes from.

Oh! Finally .... I can ask somebody who knows the facts. I was not aware of your history.

ReplyDeleteI understand what happens or the past practice of FDIC when a couple of banks go belly-up.

After a major economic collapse as what happened in 1929, (or if hundreds of banks went under overnight) how long does the law give FDIC to reimburse depositors?

I would think that there must be something in the law which would dictate a time frame of sorts? One would think that it must be spelled out quite specifically? You just could not have people lining up to collect the day after. There must be some method and timeframe of payouts?

I read somewhere that it was 15 years and I can't remember where I read it.

I have a collection of a half million articles and commentaries and it is referred to somewhere in the text, but my search module would go on endlessly with a simple search term of "15 years". I guess I could find it if I viewed the SQL-database as a text file, but it is huge.

I was hoping you would have the answer.

Calm

FDIC insurance did not exist until 1934. The 1980s constituted the greatest challenge ever to the deposit insurance fund. Not a single insured depositor lost a cent. I doubt very much that any depositor lost any access to their bank deposits for any time at all.

DeleteThe FDIC does not cut checks to depositors. They simply stand behind a failed bank's insured deposits and pay claims against those deposits in the ordinary course of banking business. There is zero interruption. Your ATM keeps working as does your checking account.

Thank you for your reply.

ReplyDeleteCalm