The decisive Greek vote today to reject the depression economics of the IMF and its Eurozone partners may well prove to be an important watershed in history. One needs only passing familiarity with European history to understand why.

Before 1945, the entire continent seemed locked in an endless spiral of wars that continually and increasingly wrecked havoc on the people and economies of Europe. From Waterloo and Verdun to Stalingrad and Auschwitz, Europe seemed destined to find new ways to kill more people and seemed ready to march off to bloodbath after bloodbath.

When the Soviet Union and communism fell in the late 1980s and early 1990s, the United States remained as the sole superpower. Under the umbrella of that power and NATO, European wars vanished and progressive European integration led to economic prosperity and stability. Most of Eastern Europe joined NATO and the western capitalist order. The Euro was introduced in 1999 in 11 Eurozone nations. All was well in Europe through 2008.

When the US allowed its financial sector to engage in an orgy of senseless mortgage lending and to peddle these loans fraudulently across the world in the cause of massive short term compensation payments to a handful of financial elites, credit markets ultimately collapsed in spectacular fashion in 2008. Suddenly, newly risk-averse credit markets realized that not all Eurozone debt carried the same risk of default, and that Greece was not in fact Germany when it came to credit risk. Interest rates in Greece, and other Southern European nations soared, leading to a new credit crisis in Europe and economic downturns throughout the Eurozone. For example, here is a comparison between Greek interest rates and German interest rates from before the introduction of the Euro through today:

In 2010, it became clear that Greece and other nations needed help in managing their debt burden and the IMF, the European Central Bank and Eurozone nations bailed-out Eurozone members flirting with default. Unfortunately, the bailouts suffered from two major problems.

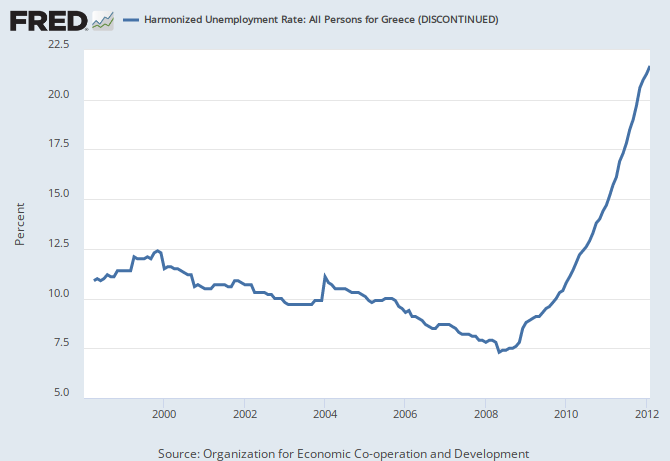

First, rather than following standard economic teaching about how to address an economic crisis through fiscal and monetary expansion the bailouts imposed severe, even ridiculous austerity upon the nations in crisis. Predictably, unemployment soared and depressions struck the entire Southern periphery of the Eurozone. Debt burdens increased rather than decreased in response. How bad was the economic contraction arising from the austerity? Consider the graph below which shows unemployment in Greece soaring under austerity, to unprecedented highs:

Second, the bailout money never really helped the Greek people (or other people in the Eurozone), but instead was used to protect the largest German and French banks from losses as a result of the unsustainable nature of the Greek Debt. About 77 percent of all of the bailout money ended up in the pockets of the European megabanks.

The vote today to reject any further austerity measures was nothing short of a democracy rejecting further economic oppression at the hands of foreign bureaucrats that they did not elect. It was a predictable political backlash that was first discussed on this blog over six months ago. When given a choice people will vote against depression economics and loss of sovereignty to unelected foreign bureaucrats every time.

Yet this creates new risks for Europe. First, the more Greece is alienated from the Europe the more likely it is that will fall into a closer relationship with Russia, undermining NATO. Second, if the EU and IMF cannot save Greece and offers only ill-founded measures sure to exacerbate any financial crisis for any Eurozone member, then Italy, Spain and Portugal will certainly come under economic and financial pressure as the next dominoes to potentially fall. Third, the political risks of the Eurozone crisis now threaten to spiral out of control as the increasing pain inflicted upon the Greek people seems likely to backfire on the Eurozone and cause deep skepticism throughout the voting public from Britain to France to Spain.

In sum, the vote today for Greece to reject further austerity as demanded by the Eurozone and the IMF promises to rock financial markets, create economic headwinds worldwide, destabilize NATO, and put enhanced pressure on the political and economic foundations of the entire European project.

If this goes wrong, as appears almost certain now, the exit of Greece from the Eurozone may result in costs that will prove many times higher than debt relief for Greece and a massive new Marshall Plan for all of Southern Europe to create jobs for all and positive economic growth. Such investment would reduce debt burdens by spurring growth. And, the world desperately needs growth today.

No comments:

Post a Comment