Random thoughts:

“Let’s be honest about this. Let’s be absolutely blunt about

it: There were appeals to racism in this campaign, and there is racial bias in

this country, and there is sexism in this country,” Axelrod said on CNN early

Wednesday morning, after former President Trump was projected as the winner

over Vice President Harris. A September survey from The Associated Press/NORC

Research Center showed 38 percent of voters think being a woman hurt Harris’s

chances of winning, and only 13 percent of voters said the same about the GOP

nominee.

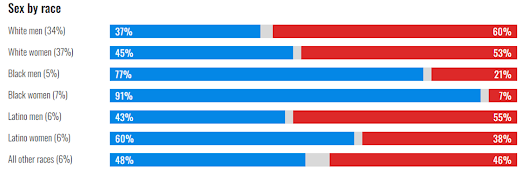

“To Trump’s top aides, the thesis

of the campaign could be summed up in a simple slogan: “Max out the men and

hold the women.” That meant emphasizing the economy and immigration, which

Trump did relentlessly. It meant diverting attention away from the chaos of his

first term, the abortion bans he ushered in, and his assault on American

democracy four years ago. It meant a campaign that rode the resentment of

disenchanted voters and capitalized on the cultural fractures and tribal

politics that Trump has long exploited. Most of all, the outcome can be

credited to a singular figure whose return to the White House traced a

political arc unlike any in 250 years of American history. Trump left office in

2021 a pariah after inciting a mob of supporters to ransack the U.S. Capitol at

the end of an attempt to overturn his electoral defeat. Three years later, he

engineered an unprecedented political comeback. Trump effortlessly dispatched

his GOP rivals, forced President Joe Biden out of the race, and vanquished Vice

President Kamala Harris in a dominant victory that exceeded virtually

everyone’s expectations. Along the way, Trump shrugged off a 34-count felony

conviction and an array of other criminal indictments.”

https://time.com/7172052/how-donald-trump-won-2024/

“We are a country that just elected – that just willfully

chose – one of the most cruel, unscrupulous and transparently self-serving

political figures in modern history to be president. Again. We just elected a

convicted felon who has normalized bullying, spread hate like an industrial

sprinkler and shown us over and over and over again he sees laws as irrelevant

and self-enrichment as sacrosanct. Faced with a billowing ocean of red flags –

from indictments for trying to overturn the 2020 election to the coddling of

dictators who rule enemy nations – a majority of Americans cast their vote for

the man who is a totem of the worst in all of us.”

“His team’s data clearly showed that the highest return on

investment would be a group that didn’t often vote: younger men, including

Hispanic and Black men who were struggling with inflation, alienated by

left-wing ideology and pessimistic about the country. The Trump campaign

committed its limited resources, including the candidate’s time, to

communicating with these young men, embracing a hypermasculine image. His first

campaign stop after his criminal conviction was an Ultimate Fighting

Championship event. He entered the Republican National Convention one night to

James Brown’s “It’s a Man’s Man’s Man’s World.” He spent relatively little time

doing mainstream media interviews and instead recorded a series of podcast

interviews with male comedians and other bro-type personalities who tapped into

the kind of audiences Mr. Fabrizio’s data said were most receptive to Mr.

Trump’s message. They included a three-hour podcast with Joe Rogan that racked

up more than 45 million views on YouTube, and won Mr. Rogan’s election-eve

endorsement. Aides and allies like Mr. Musk made explicit appeals to men to

vote for Mr. Trump in the contest’s final hours.”

https://www.nytimes.com/2024/11/07/us/politics/trump-win-election-harris.html

"White voters have sided with Republicans in every presidential election since at least 1976. And in this election, white voters went up as a share of the electorate from 67% to 71%. That is remarkable, considering that, quite simply, white people are a smaller share of the population in the country than ever before. They have been steadily declining as a share of eligible voters, and that is not changing any time soon because of growth with Latinos and Asian Americans. So the fact that they were a larger share of the electorate than four years ago was a boon to Trump."

https://whyy.org/articles/2024-election-how-trump-won-takeaways/

?It may be the biggest story of the race: Latino voters swung

toward Trump by a staggering 25 percentage points compared with four years ago.

Trump won the support of 45% of Latino voters nationally compared with 53% for

Harris, the NBC News Exit Poll found. That's far better than the 33-point loss

Trump suffered among Latinos in 2020, when he won 32% to Joe Biden’s 65%. And

it may end up being the strongest GOP performance among Latinos in a

presidential race since George W. Bush carried 44% in 2004. Nationally, Latinos

accounted for 12% of the electorate, and Trump’s gains are boosting his margins

across a host of battleground states, from Pennsylvania to Arizona, which

complicated Harris’ path. Trump's gains were fueled by a massive shift among

Latino men, who backed him over Harris by 10 points."

"* Trump wins 56% of voters without a college degree

nationwide; Harris wins 42%. Trump's share is up 6 percentage points from a

2020 exit poll.

* Harris wins 55% of voters with college degrees nationwide;

Trump wins 42%. Trump's share is down 1 percentage point from a 2020 exit poll."

https://www.reuters.com/world/us/results-nevada-exit-poll-us-presidential-election-2024-11-05/

https://www.latimes.com/opinion/story/2024-11-07/white-women-vote-donald-trump-kamala-harris

"Now, in 2024, the story of red America’s minority status as

an economic power continues unabated, albeit with unmistakable gains. This

year, Brookings calculations suggest that President-elect Donald Trump’s

winning base in 2,523 counties represents 87% of the nation’s total counties

but just 40% of the nation’s GDP. Conversely, Vice President Kamala Harris’

losing base of 376 much higher-output counties represents 60% of the GDP."

"First, incumbents

worldwide were facing tough election odds. Electorates were frustrated by the

COVID inflationary years and were clearly seeking change. In Australia, Sweden,

the Netherlands, France, and beyond, ruling coalitions lost power across the political

spectrum. Second, I don’t think Kamala Harris was ever going to be a great

candidate. After Biden’s disastrous debate effort in late June and it seemed he

might be pressured to drop out, I wrote an article calling on Democrats not to

coronate their vice president, and pointing to key vulnerabilities she

displayed and the value of an open democratic process."

"I think that she,

by all accounts, ran a strong campaign that was based on her strengths. And I

think she had an undeniably dominating debate performance. They ran a nice

convention. Her speeches were good. The messaging pivot, the launch was good.

There wasn’t a lot of drama inside the campaign, right? There are other things

that she isn’t particularly strong at. I don’t think that she is that great in

unscripted moments. Sometimes she’s better than others."

"Elon Musk's super

PAC spent around $200 million to help elect Donald Trump , according to a

person familiar with the group's spending, funding an effort that sets a new

standard for how billionaires can influence elections. The billionaire Tesla

and SpaceX CEO provided the vast majority of the money to America PAC, which

focused on low-propensity and first-time voters, according to the person, who

was not authorized to disclose the figure publicly and spoke on condition of

anonymity. America PAC's work was aided by a March ruling from the Federal

Election Commission that paved the way for super PACs to coordinate their

canvassing efforts with campaigns, allowing the Trump campaign to rely on the

near-unlimited money of the nation's most high-profile billionaire to boost

turnout in deep-red parts of the country. That allowed the campaign to spend

the money they saved on everything from national ad campaigns to targeted

outreach toward demographics Democrats once dominated. “By conserving hard

dollars, we were able to go wider and deeper on paid voter contact and

advertising programs,” Blair said. That, he added, included broad ad campaigns

aimed at a national audience, as well as — critically — more targeted campaigns

seeking to boost turnout among Black and Latino men, two areas where Trump saw

sweeping gains in 2024."

https://apnews.com/article/elon-musk-america-pac-trump-d248547966bf9c6daf6f5d332bc4be66

"Presidential

historian Allan Lichtman, who had predicted that Vice President Kamala Harris

would win the 2024 presidential election against former President Donald Trump,

mainly attributed his incorrect prediction to the proliferation of online

misinformation and disinformation. Lichtman, who had correctly predicted nearly

every presidential race since 1984 using a formula of 13 true-or-false

questions, cited the influence of social media platforms including Elon Musk’s

X as one of the reasons he was wrong. The American University professor said

Monday on NewsNation’s “CUOMO” that “disinformation has exploded to an

unprecedented degree. We’ve seen something brand new this time: Elon Musk

putting his thumb on the scales through his control of X.”

"Lichtman blamed

disinformation first and foremost, and called out two culprits by name: “You

talked about a grievance-driven election, but a lot of that grievance was

driven by disinformation. It starts with Fox News and conservative media.

Conservative podcasters with tens of millions of views. But we’ve seen

something brand new this time—the $300 billionaire, Elon Musk, putting his

thumb on the scales through his control of X, formerly Twitter.” Lichtman said

that voters were given “vast disinformation” on a variety of issues, including

jobs, immigration, unemployment, the ongoing war in Ukraine, and even hurricane

relief. The second factor, according to Lichtman, was what he called the “dark

side of American history”—elements that included “racism, misogyny, xenophobia,

antisemitism.”"

"Fox and Musk have

gotten away with spreading disinformation because of a self-serving

misapprehension of the political speech doctrine: The First Amendment protects

‘core political speech’ above all other forms of expression. But Musk

purchasing the world’s town square only to weaponize it to support his own

agenda, and Fox admittedly lying to viewers nonstop to promote Trump, isn’t

political speech presumptively entitled to legal protection. Weaponized

disinformation will ultimately kill the First Amendment, which the Supreme

Court recognized back in 1969 when it approved the Fairness Doctrine and

required accuracy in the media."

https://www.msn.com/en-ca/news/politics/trump-didn-t-win-disinformation-did-opinion/ar-AA1tRicR

"To improve their

standing in Washington, some of the country’s crypto elite had spent years

pouring money into politics: They donated heavily to former president Donald

Trump, while flooding congressional races nationwide with advertisements that

promoted crypto-friendly candidates. Soon after the polls closed, those efforts

appeared to pay off. Trump clinched a return to the White House, and by

Wednesday afternoon, 43 of the 58 congressional candidates backed by a trio of

new crypto-funded super PACs had been declared the winners of their races. The

groups, led by the organization Fairshake, spent more than $130 million

nationally to advertise in congressional contests, some of which have not yet

been called."