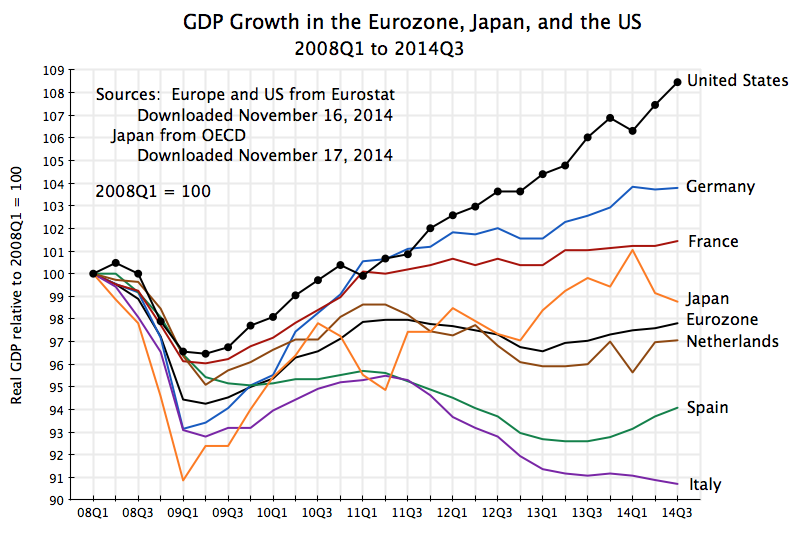

Understandably, GOP presidential nominee Donald Trump and the rump of the GOP still standing behind his "bigoted" campaign (in the words of former and current GOP representatives) do not want to talk about the accompanying chart at right. They claim the USA economy is "ruined." The chart at right proves them wrong and proves that President Obama can rightly claim that the US economy is the "envy of the world."

Understandably, GOP presidential nominee Donald Trump and the rump of the GOP still standing behind his "bigoted" campaign (in the words of former and current GOP representatives) do not want to talk about the accompanying chart at right. They claim the USA economy is "ruined." The chart at right proves them wrong and proves that President Obama can rightly claim that the US economy is the "envy of the world."President Obama is not the only one making this claim. The Economist termed the US economy the "lonely locomotive" of growth in a world mired in stagnation. The OECD reckons that since 2008 the US economy is 11 percent larger, while the Eurozone and Japan have grown by a small fraction of this number. The out-performance of the US economy under President Obama is a reality-based fact!

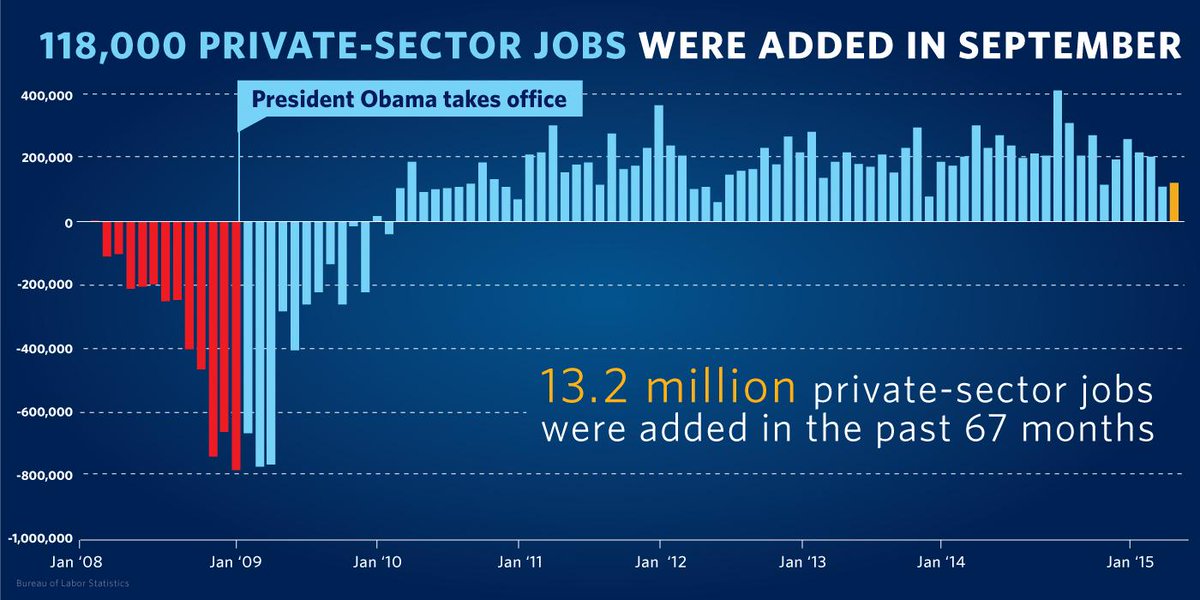

Further, with respect to the crucial question of job growth, President Obama's policies led to more than 14 million new jobs since the depths of the crisis of 2008. Even a cursory look at job growth in the USA since the Bush Administration (see chart below) proves that the GOP led the economy to the greatest job destruction in modern history. According to the Wall Street Journal, George W. Bush had the worst job creation record since WWII. President Obama quickly turned around the massive job losses he inherited, and has now presided over 70 straight months of job growth.

And, the most recent jobs report from the US Department of Labor is perhaps one of the best yet. Wages were up. The employment ratio was up. The US is now creating more jobs than at any other time since the last Clinton years.

Certainly, more job growth would be better, particularly for the middle class. Inequality is also a major barrier to continued economic growth. Economic weakness across the world further hinders US export growth. Global growth in turn would lead to more impressive job growth.These topics warrant separate posts, for another day.

Certainly, more job growth would be better, particularly for the middle class. Inequality is also a major barrier to continued economic growth. Economic weakness across the world further hinders US export growth. Global growth in turn would lead to more impressive job growth.These topics warrant separate posts, for another day.The key point for this post is that after a devastating economic collapse in 2008, after 8 years of GOP control, the US economy has achieved the most impressive economic recovery among developed nations. The entire developed world suffered a massive heart attack in 2008, and faced a total financial collapse; the US recovered the fastest and has enjoyed the most growth since the crisis.

The charts herein and the facts cited above show beyond dispute that the USA outperformed the entire world after the GOP trashed the economy the last time they controlled the government. After 8 years of GOP leadership, the US economy cratered in 2008, losing over 800,000 jobs per month. It now produces hundreds of thousands of jobs per month, month after month.

What particular policies led to this historic turnaround?

The OECD attributes the US recovery to government policies, including Obama's stimulus bill and financial stability, secured by the Dodd-Frank Act. Indeed, the OECD finds that:

Efforts to raise further capital requirements for large financial institutions, reduce fragmentation among regulators, and introduce macro-prudential tools is justified. In this respect, full implementation of Basel III and the Dodd-Frank Act is critical.

Efforts to raise further capital requirements for large financial institutions, reduce fragmentation among regulators, and introduce macro-prudential tools is justified. In this respect, full implementation of Basel III and the Dodd-Frank Act is critical.

I have previously criticized the Dodd-Frank Act for being incomplete, too weak, and too pro-banker. That is why I agree with Hillary Clinton and the experts at the OECD that it should be fully implemented and expanded. After all, the American economy outperformed the entire developed world after the financial crisis while Dodd-Frank became law and regulators implemented its mandates.

Yet, Trump wants to go the opposite direction. Trump quite clearly wants to "rip up" Dodd-Frank and return to the 2008 pre-Dodd-Frank legal and regulatory reality that spawned the Great Financial Crisis. This is the key difference between Trump and Clinton on the issue of bank regulation according to the Wall Street Journal. Indeed, Trump has already met with congressional leaders to plot the repeal of Dodd-Frank, suggesting that unlike most of his other crazy ideas he is quite serious about returning to the dark days of later 2008.

But given the impressive and successful performance of the US economy after the Great Financial Crisis of 2008, it just makes no sense to return to the same legal and regulatory reality that spawned that crisis. Why even roll the dice? If the gamble goes wrong (as so many Trump gambles do) it could mean mass unemployment like that which occurred prior to the inauguration of President Obama.

What particular policies led to this historic turnaround?

The OECD attributes the US recovery to government policies, including Obama's stimulus bill and financial stability, secured by the Dodd-Frank Act. Indeed, the OECD finds that:

I have previously criticized the Dodd-Frank Act for being incomplete, too weak, and too pro-banker. That is why I agree with Hillary Clinton and the experts at the OECD that it should be fully implemented and expanded. After all, the American economy outperformed the entire developed world after the financial crisis while Dodd-Frank became law and regulators implemented its mandates.

Yet, Trump wants to go the opposite direction. Trump quite clearly wants to "rip up" Dodd-Frank and return to the 2008 pre-Dodd-Frank legal and regulatory reality that spawned the Great Financial Crisis. This is the key difference between Trump and Clinton on the issue of bank regulation according to the Wall Street Journal. Indeed, Trump has already met with congressional leaders to plot the repeal of Dodd-Frank, suggesting that unlike most of his other crazy ideas he is quite serious about returning to the dark days of later 2008.

But given the impressive and successful performance of the US economy after the Great Financial Crisis of 2008, it just makes no sense to return to the same legal and regulatory reality that spawned that crisis. Why even roll the dice? If the gamble goes wrong (as so many Trump gambles do) it could mean mass unemployment like that which occurred prior to the inauguration of President Obama.

ReplyDeleteNice Post. Thanks for sharing such an informative post. Go through the recent similar valuable blogs about Hire Bookkeeping services in chicago.

Yes, good financial accounting and bookkeeping makes management easy. If you are using Quickbooks and want to know "How to Contact Quickbooks Error Support", then follow the link.

ReplyDeleteThis comment has been removed by the author.

ReplyDelete