Sometimes events seemingly outstrip human influence leading to worldwide catastrophe. August 1914 led to 16 million deaths (and ultimately World War II) all triggered by the assassination of an obscure Archduke from the Austro-Hungarian Empire on June 28, 1914.

1931 was such a year, when the failure of Credit Anstalt in Vienna triggered a world wide bank run and flight to safety that transmogrified the Crash of 1929 into the Great Depression. As BusinessWeek recently stated:

"In May 1931, a Viennese bank named Credit-Anstalt failed. Founded by the famous Rothschild banking family in 1855, Credit-Anstalt was one of the most important financial institutions of the Austro-Hungarian Empire, and its failure came as a shock because it was considered impregnable. The bank not only made loans; it acquired ownership stakes in all kinds of companies throughout the sprawling empire, from sugar producers to the new automobile makers. Its headquarters city, Vienna, was a place of wealth and splendor, famous for its opera, balls, chocolate, psychoanalysis, and the extravagant architecture of the Ringstrasse. The fall of Credit-Anstalt—and the dominoes it helped topple across Continental Europe and the confidence it shredded as far away as the U.S.—wasn't just the failure of a bank: It was a failure of civilization."

The end result of this bank failure in far away Vienna was massive bank runs around the world, first, in Berlin (because banks there had deposits in Credit Anstalt), then in London (because banks there lent to German banks) and ultimately the US (because who knows what bank is safe if all the European banks go down the tubes). The Great Depression then took full hold around the world leading to 25% unemployment in the US and a 30% plunge in economic output. Soon thereafter political extremism in Europe led to the horrors of World War II.

Today, mainstream economists are raising the specter of a 1931 type of event, where an economic shock in Europe leads to a global panic resulting in a massive and sudden withdrawal of credit from the global economy. Paul Krugman:

"As in 1931, Western nations have the resources they need to avoid catastrophe, and indeed to restore prosperity — and we have the added advantage of knowing much more than our great-grandparents did about how depressions happen and how to end them. But knowledge and resources do no good if those who possess them refuse to use them. And that’s what seems to be happening. The fundamentals of the world economy aren’t, in themselves, all that scary; it’s the almost universal abdication of responsibility that fills me, and many other economists, with a growing sense of dread."

From the University of California, Brad De Long and Barry Eichengreen:

"The parallels between Europe in the 1930s and Europe today are stark, striking, and increasingly frightening. We see unemployment, youth unemployment especially, soaring to unprecedented heights. Financial instability and distress are widespread. There is growing political support for extremist parties of the far left and right." As shown above, political extremism is on the march in places like Spain.

Nouriel Roubini and Niall Ferguson:

"Is it one minute to midnight in Europe? We fear that the German government’s policy of doing “too little too late” risks a repeat of precisely the crisis of the mid-20th century that European integration was designed to avoid. We find it extraordinary that it should be Germany, of all countries, that is failing to learn from history. Fixated on the non-threat of inflation, today’s Germans appear to attach more importance to 1923 (the year of hyperinflation) than to 1933 (the year democracy died). They would do well to remember how a European banking crisis two years before 1933 contributed directly to the breakdown of democracy not just in their own country but right across the European continent."

Obviously, we have reached a major danger point in economic history. I

first wrote about the parallels of the Eurozone crisis to 1931 and

Credit Anstalt in late 2011. Since then the European Central Bank flooded the system with liquidity--but liquidity never solves a crisis based upon insolvency. And, in Europe too many nations and banks are simply insolvent. So, the sugar high is about over and massive capital is fleeing Europe in favor of safe havens. That is why Treasury yields are so low.

Economically, the pain of a financial crisis is a function of the volume and rapidity of the withdrawal of capital from an economy into safe havens. For a picture of economic pain projected for the Eurozone given its current path, see this graph from Der Spiegel out of Berlin. As I have repeatedly argued, these numbers, which must be added to already grim economic realities, portend a calamity worse than Lehman. Indeed, these numbers promise a global depression.

But, that may not be the worst of it. Painful economic disruptions historically lead to painful political extremism, especially in Europe. And, unfortunately, signs abound that severe political disruptions loom once again in Europe, as I will highlight in my next post.

Tuesday, June 26, 2012

Monday, June 18, 2012

Conference and Book on Implicit Bias Elevate the Discourse on Race

I attended a conference last week at Harvard Law School

Tuesday, June 12, 2012

Pain in Spain Falls on All but the Megabanks

So, the media is full of stories that the Eurozone is bailing out Spain--but it is not and will not work. My objection is this: in fact, Spain is not being bailed out. The Spanish people are bailing out the Eurozone megabanks by undertaking $125 billion of new indebtedness so that the Spanish banks can continue to pay Eurozone banks interest and principal and Spanish bankers can continue in power.

Let me explain, using the FDIC Resolutions Handbook for failed banks. According to the FDIC resolution manual, when the FDIC takes over a failed bank it only protects the depositors. Senior management gets sacked (p. 85) and unsecured creditors only get "receivership certificates." A receivership certificate "entitles its holder to a portion of the receiver’s collections on the failed institution’s assets." (p. 5). In other words, the unsecured creditors get any positive net worth remaining after resolution--which is usually nothing because healthy banks with positive net worth are generally not placed in receivership. Simply put, neither managers nor unsecured creditors get deposit insurance, backed by the full faith and credit of the United States Government (see official FDIC teller decal, above).

On the other hand, the Eurozone guidelines for EFSF bailouts, like that for Spain, are only available for systemically important financial institutions and do not preclude payments to unsecured creditors. Indeed, the whole point of the Eurozone bailout for systemically important institutions is to assure protection of the financial system--that is payment to other big banks in Europe. (As the EFSF guidelines state: "A candidate for recapitalisation will have to be a distressed financial institution systemically relevant or posing a threat to financial stability."). Thus, while shareholders do appropriately suffer losses under an EFSF bailout--general unsecured creditors do not necessarily face pain of loss, particularly if "contagion" could result. Finally, the Eurozone guidelines allow each nation-state to indulge its financial elites by failing to mandate their dismissal (much less investigation leading to possible indictment or civil liability). Derivatives counter-parties get protection as do megabanks more generally (under the rubric of "contagion").

This is nuts! Sovereign nations now effectively guarantee derivatives contracts involving megabanks. At a cost of hundreds of billions of Euros the Eurozone now stands behind every derivatives contract involving a Eurozone bank. Overstatement?

Well, the depth of the Eurozone commitment to saving the big banks is evident in the pain it tolerates for the people of Spain. Spain has Great Depression levels of unemployment approaching 25%. Over 50% of its youth is unemployed. The government continues to push extreme austerity on its people with wage freezes and deep cutbacks for public sector employees. Health and education expenditures face high cuts. And, now Spain promises more austerity ahead. Yet, here in Spain, I see no evidence that the banking elites that caused this crisis face any loss of power, prestige, position or money. (Although the Socialist Party is stirring).

None of this makes economic sense. When I worked at the FDIC we worked to maintain rational economic incentives for bankers. Those committing bankicide were served subpoenas and it was my job to make criminal referrals or to sue to recover damages. I recall bankers breaking down in tears under questioning about how their bank had failed. It was on many levels unpleasant work. But rational banking incentives matter. Today, these bailouts send an inescapable message: bankers may speculate all they want because the governments will bankroll their folly to the tune of billions or even trillions. The only way to stop bank failures is to stop guaranteeing bank failures and to make the failure of a bank very painful for senior managers and unsecured creditors like bond holders or derivatives counter-parties.

So, the Eurozone now provides hundreds of billions to protect the megabanks from their own speculative excess and pain and economic misery for people who foot the bill. It is difficult to imagine a more destructive economic reality or a more morally reprehensible policy. This new policy of giving megabanks an unlimited and first claim on public wealth will doom us all.

As in World War II, perhaps Spain is again a prelude for the challenges coming to the US.

Let me explain, using the FDIC Resolutions Handbook for failed banks. According to the FDIC resolution manual, when the FDIC takes over a failed bank it only protects the depositors. Senior management gets sacked (p. 85) and unsecured creditors only get "receivership certificates." A receivership certificate "entitles its holder to a portion of the receiver’s collections on the failed institution’s assets." (p. 5). In other words, the unsecured creditors get any positive net worth remaining after resolution--which is usually nothing because healthy banks with positive net worth are generally not placed in receivership. Simply put, neither managers nor unsecured creditors get deposit insurance, backed by the full faith and credit of the United States Government (see official FDIC teller decal, above).

On the other hand, the Eurozone guidelines for EFSF bailouts, like that for Spain, are only available for systemically important financial institutions and do not preclude payments to unsecured creditors. Indeed, the whole point of the Eurozone bailout for systemically important institutions is to assure protection of the financial system--that is payment to other big banks in Europe. (As the EFSF guidelines state: "A candidate for recapitalisation will have to be a distressed financial institution systemically relevant or posing a threat to financial stability."). Thus, while shareholders do appropriately suffer losses under an EFSF bailout--general unsecured creditors do not necessarily face pain of loss, particularly if "contagion" could result. Finally, the Eurozone guidelines allow each nation-state to indulge its financial elites by failing to mandate their dismissal (much less investigation leading to possible indictment or civil liability). Derivatives counter-parties get protection as do megabanks more generally (under the rubric of "contagion").

This is nuts! Sovereign nations now effectively guarantee derivatives contracts involving megabanks. At a cost of hundreds of billions of Euros the Eurozone now stands behind every derivatives contract involving a Eurozone bank. Overstatement?

Well, the depth of the Eurozone commitment to saving the big banks is evident in the pain it tolerates for the people of Spain. Spain has Great Depression levels of unemployment approaching 25%. Over 50% of its youth is unemployed. The government continues to push extreme austerity on its people with wage freezes and deep cutbacks for public sector employees. Health and education expenditures face high cuts. And, now Spain promises more austerity ahead. Yet, here in Spain, I see no evidence that the banking elites that caused this crisis face any loss of power, prestige, position or money. (Although the Socialist Party is stirring).

None of this makes economic sense. When I worked at the FDIC we worked to maintain rational economic incentives for bankers. Those committing bankicide were served subpoenas and it was my job to make criminal referrals or to sue to recover damages. I recall bankers breaking down in tears under questioning about how their bank had failed. It was on many levels unpleasant work. But rational banking incentives matter. Today, these bailouts send an inescapable message: bankers may speculate all they want because the governments will bankroll their folly to the tune of billions or even trillions. The only way to stop bank failures is to stop guaranteeing bank failures and to make the failure of a bank very painful for senior managers and unsecured creditors like bond holders or derivatives counter-parties.

So, the Eurozone now provides hundreds of billions to protect the megabanks from their own speculative excess and pain and economic misery for people who foot the bill. It is difficult to imagine a more destructive economic reality or a more morally reprehensible policy. This new policy of giving megabanks an unlimited and first claim on public wealth will doom us all.

As in World War II, perhaps Spain is again a prelude for the challenges coming to the US.

Saturday, June 9, 2012

The Pain in Spain and the Scourge of the Megabanks

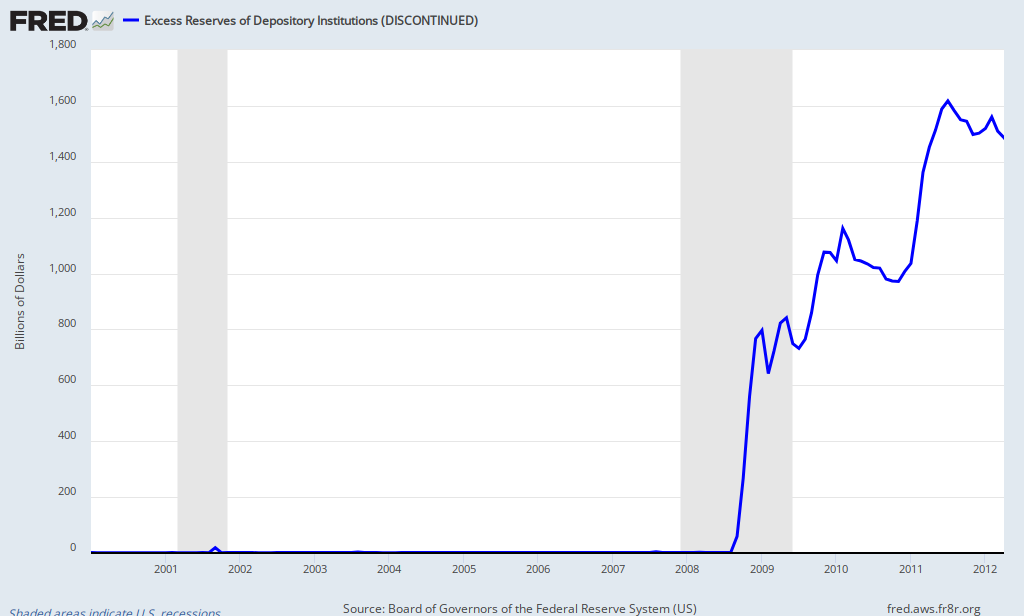

The chart above, which repeatedly has been in focus on this blog (most recently by dre cummings), shows that our banks continue to hoard vast wealth that could fund massive economic growth through new loans or through alternative government programs other than massive subsidies for the megabanks. Two factors basically drive the banks to accumulate reserves rather than lend: severe risk aversion and the ill-advised decision by the Fed to pay interest on reserves for the first time in October of 2008--thus, putting a decidedly contractionary influence upon monetary policy at the onset of a major downturn.

This new program also represents a massive transfer of money to the banks from the government. The Fed pays about .25 percent to encourage banks to hold reserves. During that same period the equivalent investment in Treasury obligations would have essentially zero yield. Basically, over four years we gave the banks about $100 billion for not investing the vast wealth that we pumped into the financial sector to keep it afloat after the financial crisis caused by the obscene recklessness of the banks. This constitutes the worst corporate welfare program in our history, for it is at once the most economically counterproductive and morally reprehensible use of social wealth imaginable. It is in short, a reflection of a banktatorship.

On May 31, I flew to Spain. Spain is today ground zero in the financial crisis and I wanted to see first hand how Spaniards are coping and what they think about the bank crisis. Just like the US, Spain is quickly shedding social programs and stunting its economic growth in order to turn the nation state into a giant bank welfare state. Thus, for example, Spain has dramatically cut coal subsidies resulting in thousands of lost jobs in the coal sector despite the fact the nation already has a 25 percent unemployment rate. At the same time, Spain is poised to inject nearly $25 billion into one of its largest banks, and the IMF suggests a total of at least $50 billion will ultimately be needed.

The economic carnage in Spain and Greece is a warning to America. Austerity for everyone but the banks is a cruel and suicidal policy. No economy can function when the state becomes an appendage of big finance. The only winners are senior bank executives and their cronies in government. Who would invest in such a pseudo-capitalist society? If banks suck all of the oxygen out of an economy who will buy any good and services produced? The brewing Euro-depression stands as a stark reminder to America that giving all social wealth to a small handful of banking elites (a policy that originated in America with the repeal of Glass-Steagall) will destroy an economy and lead to mass impoverishment.

The megabanks must be broken up and this remains the biggest issue of the coming political campaign--which likely will not even be on the table given the bi-partisan nature of the American banktatorship.

Subscribe to:

Comments (Atom)