Debt-deflation poses the ultimate threat of economic pain. At its worst, the very viability (politically and economically) of capitalism itself can be called into question under the pain of debt-deflation. The Great Depression furnishes the most painful example of debt-deflation thus far in modern capitalist economies. In the US, unemployment soared to 25 percent and in the election of 1932 the communist and socialist parties attracted 1 million votes.

Why is debt-deflation so dangerous?

First, in a deflationary reality, people will rationally slow down all spending, constantly delaying purchases of all sorts to take advantage of lower prices. This spending slow-down then spirals, as firms respond to lower revenues by slashing costs, especially employees. As unemployment increases spending necessarily falls further, necessitating more spending cuts in the business sector. In an economy where about 70 percent of all economic activity is consumer-driven, as ours is today, it is easy to see that the threat of deflation can quickly spiral out of control leading to massive unemployment and macroeconomic pain for all.

Second, once deflation takes root, investment is bound to falter. During the Great Depression investment plunged by over 80 percent between 1929 and 1933. Falling prices, unemployment and reduced consumption simply do not inspire investment. Risk aversion becomes the norm as creditors will even accept negative interest rates as investment opportunities shrivel away and currency becomes more valuable over time. These negative rates both reflect and amplify dire investment options and ultimately lead to financial disintermediation as people opt for cash rather than even bank deposits. The withdrawal of capital from the economy then operates to further restrict growth.

Third, and most ominously, consider debt in a deflationary environment. Debt taken out in a non-deflationary environment (often during a bubble) becomes unsustainable in a deflationary environment because dollars by definition become more valuable and scarce. So, debt burdens soar in real terms. Defaults necessarily soar too, and the financial sector then succumbs to losses. Capital freezes, much like what occurred in the wake of the Lehman failure in 2008. Highly indebted societies feel the greatest macroeconomic pain from debt-deflation.

Three simple steps toward macroeconomic catastrophe.

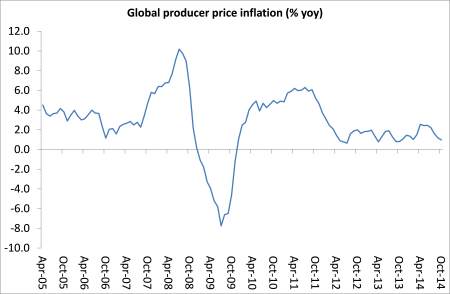

Of course, it could never happen today, right? Wrong--it is happening as you read. As the chart above shows, the world has been flirting with deflation for years. Even before the oil price plunge of recent weeks, as The Economist shows, virtually the entire developed world was already perched on a deflationary precipice. Deflationary pressures are growing dramatically, as I demonstrated last week with this blog post.

Most particularly, the recent plunge in crude oil constitutes the greatest deflationary shock to the global economy since the failure of Lehman Brothers. A huge part of the decline is demand driven, as the International Energy Agency and others continually cut demand estimates, including on Friday which led to the stock market carnage. The price of oil is simply now in a free fall:

In fact, late last week the price fell off the above chart to $57 per barrel. The price drop reflects massive economic slow-downs across the world especially China, Germany, the Eurozone in general, and Japan. Now oil and other commodity price plunges are dragging nations like Norway, Russia, Venezuela, Nigeria into recessions. The deflationary spiral has begun. This deflationary price spiral bodes ill for the global economy.

Far worse, however, is its impact on asset values and accompanying losses in the financial sector. For example, both Russian and Venezuelan bonds seem headed for default. Energy now constitutes 16 per cent of the US junk bond market, up from 4 percent ten years ago. So, high yield debt markets are silently crashing. The fear is now spreading beyond energy. In fact, the flight to safety has turned into a mad rush--as evidenced by plunging yields in US Treasury debt.

So where precisely in the financial sector will those losses fall. Only the great derivatives wizard knows for sure but a good place to guess is the US megabanks who control 95% of the derivatives market in the US, as I will discuss in my next post.

Can this all be averted? Of course, through vigorous and broad based monetary and fiscal stimulus. I will address these mainstream solutions in a subsequent post.