The United States Department of Justice announced today that it no longer intends to house federal inmates in private, for-profit prisons. The DOJ cited its own study finding that private prisons "simply do not provide the same level of correctional services,

programs, and resources; they do not save substantially on costs; and as

noted in a recent report by the Department's Office of Inspector

General, they do not maintain the same level of safety and security." In a memo released by Deputy Attorney General Sally Q. Yates, federal prison officials were directed to no longer renew contracts with private prison corporations, like the Corrections Corporation of America and the GEO Group, or to significantly reduce the scope of the contract with the end-goal of eliminating federal use of private prison facilities. According to Deputy Yates' release: "Today, I sent a memo to the Acting Director of the Bureau of Prisons

directing that, as each private prison contract reaches the end of its

term, the bureau should either decline to renew that contract or

substantially reduce its scope in a manner consistent with law and the

overall decline of the bureau’s inmate population. This is the first

step in the process of reducing—and ultimately ending—our use of

privately operated prisons."

This is clearly not good news for CCA, the GEO Group, and other for-profit private prison operators. The federal government had steadily supplied prisoners to these profit centers for the past decade as mass incarceration overwhelmed good moral and fiscal judgment in the United States. In fact, CCA and GEO Group stock plunged nearly 40% upon the news today. CNN reports: "[A]dvocates for prison reform believe this could be the

beginning of the end for private prisons. Wall Street appears to agree.

The stocks of two of the largest private prison operators fell

dramatically after The Washington Post reported the news. Corrections Corporation of America (CXW) lost 40% of its value Thursday. Geo Group (GEO) also slumped about 40%"

The Street reports: "Shares of private prison operators have plunged to new lows for the year on steep declines Thursday following the [DOJ's] decision to effectively end contracts with those companies. . . . Neither company [CCA or GEO] figures to weather this storm very easily, as they don't

have any significant brand extensions that insulate them from their

primary business of providing correctional facilities for the

government. In 2015, for instance, 45% of GEO revenue came from the Federal Government. However, these companies also operate state penitentiaries, which should not be directly affected by the DOJ's action."

The Corporate Justice Blog has long maintained that private, for-profit prison corporations are fundamentally immoral as its leaders are perversely incentivized to injure U.S. citizens by lobbying for harsher sentences (three-strikes laws), developing "new" crimes punishable by prison time (AZ SB 1070, crimmigration), providing poorer services to inmates in order to cut costs, and forcing cities and municipalities into signing contracts that guarantee 90% occupancy rates in the private prisons. Recent research and scholarship indicate that the promised benefits of private prisons, that they are cheaper, safer, and more efficient, are simply not true. This research shows that private prisons keep inmates locked-up longer (for same-time sentences), are less safe, and are more costly, each attributable directly to a profit motivation.

Adam Lamparello and I recently published an update on the perverse incentives that motivate private prison executives summing up the research that finds that private, for-profit prisons do not deliver on their promised efficiencies: Private Prisons and the New Marketplace for Crime.

Thursday, August 18, 2016

Friday, August 12, 2016

Trump's New Smoot-Hawley Depression?

That chapter argues that US financial and corporate elites (including the megabankers Trump wishes to free from law and regulation) rigged globalization to maximize profits from low wages world-wide and the use of unsustainable debt to spur consumption even in the face of declining job prospects throughout the developed world due to massive off-shoring of jobs to low wage locales. Globalization was not constructed or implemented with a view towards sustainable economic growth.

The book includes specific innovations to reconstruct globalization in accordance with economic science to vindicate its pro-growth potential to the maximum extent possible. These innovations include empowering all people to freely move to their highest and best use (which would double global GDP) and investing currency reserves into global infrastructure projects which would immediately spur massive global job creation. Globalization can be fixed and can operate to secure rising living standards worldwide.

Trashing globalization and pursuing protectionist policies such as higher tariffs is not a good idea. In fact, it was done before and led to global economic disaster. In 1930, the GOP-controlled Congress passed the Smoot-Hawley Tariff Act, and GOP President Herbert Hoover signed the Act into law. There is broad agreement among economists that this Act prolonged and deepened the Great Depression by raising tariffs and triggering a global trade war. According to the Economist, global trade collapsed by over 60 percent in the aftermath of Smoot-Hawley as shown in the accompanying chart.

Trashing globalization and pursuing protectionist policies such as higher tariffs is not a good idea. In fact, it was done before and led to global economic disaster. In 1930, the GOP-controlled Congress passed the Smoot-Hawley Tariff Act, and GOP President Herbert Hoover signed the Act into law. There is broad agreement among economists that this Act prolonged and deepened the Great Depression by raising tariffs and triggering a global trade war. According to the Economist, global trade collapsed by over 60 percent in the aftermath of Smoot-Hawley as shown in the accompanying chart.Yet, Donald Trump, ignoring history, consistently built his campaign on the theme of protectionism. He has pledged to slap a 45 percent tariff on Chinese imports and a 35 percent tariff on Mexican imports. We need not rely only upon history to understand the danger of Trump's economic ideas. Mark Zandi (a former economic adviser to the Senator John McCain presidential campaign in 2008) of Moody's projects that Trump's trade policy would lead to a recession, drive up unemployment to 9.5 percent, lead to up to 7 million lost jobs, and increase the national debt by 60 percent. In short, according to Zandi, it is a scenario "any rational person would want to avoid." Zandi is not the only economist that concludes that Trump's idea's would lead to risks from a severe recession to higher prices for consumers.

Even traditional GOP supporters are aghast at the sheer recklessness of Trump's promises. For example, Peter Singer, a financial expert and longstanding GOP donor states: "If he actually . . . gets elected president its close to a guarantee of a global depression, [a] widespread global depression." Former Bush Administration official, Robert Zoellick, calls Trump's trade ideas "foolhardy." He adds that free trade saves the average household $10,000 per year through lower prices on a range goods produced outside the US. In fact, no less than three former US Trade Representatives joined 50 other former GOP officials to reject Trump's candidacy and terming his proposals "most reckless."

In sum, economic science and theory, history, and expert opinion all align on Trump's trade proposals: they are dangerous, reckless, and ill-informed.

Tuesday, August 9, 2016

Trump Wants to "Dismantle" Dodd-Frank and Re-ignite the Great Financial Crisis of 2008

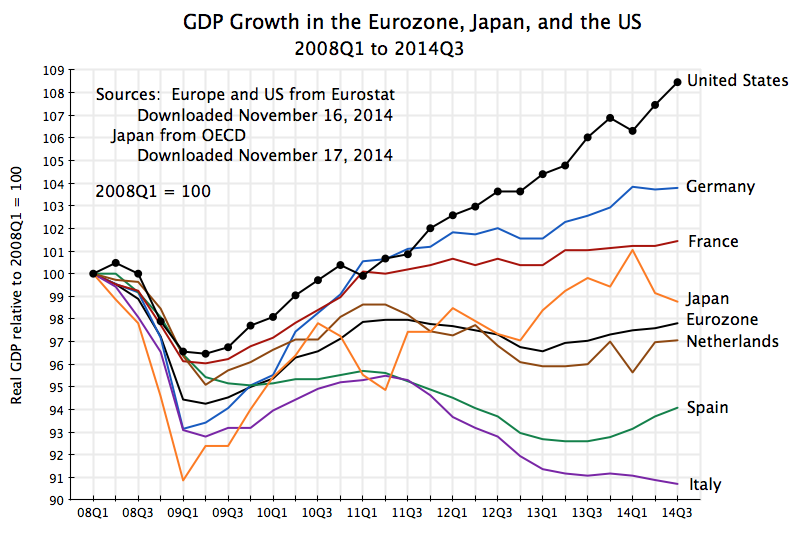

Understandably, GOP presidential nominee Donald Trump and the rump of the GOP still standing behind his "bigoted" campaign (in the words of former and current GOP representatives) do not want to talk about the accompanying chart at right. They claim the USA economy is "ruined." The chart at right proves them wrong and proves that President Obama can rightly claim that the US economy is the "envy of the world."

Understandably, GOP presidential nominee Donald Trump and the rump of the GOP still standing behind his "bigoted" campaign (in the words of former and current GOP representatives) do not want to talk about the accompanying chart at right. They claim the USA economy is "ruined." The chart at right proves them wrong and proves that President Obama can rightly claim that the US economy is the "envy of the world."President Obama is not the only one making this claim. The Economist termed the US economy the "lonely locomotive" of growth in a world mired in stagnation. The OECD reckons that since 2008 the US economy is 11 percent larger, while the Eurozone and Japan have grown by a small fraction of this number. The out-performance of the US economy under President Obama is a reality-based fact!

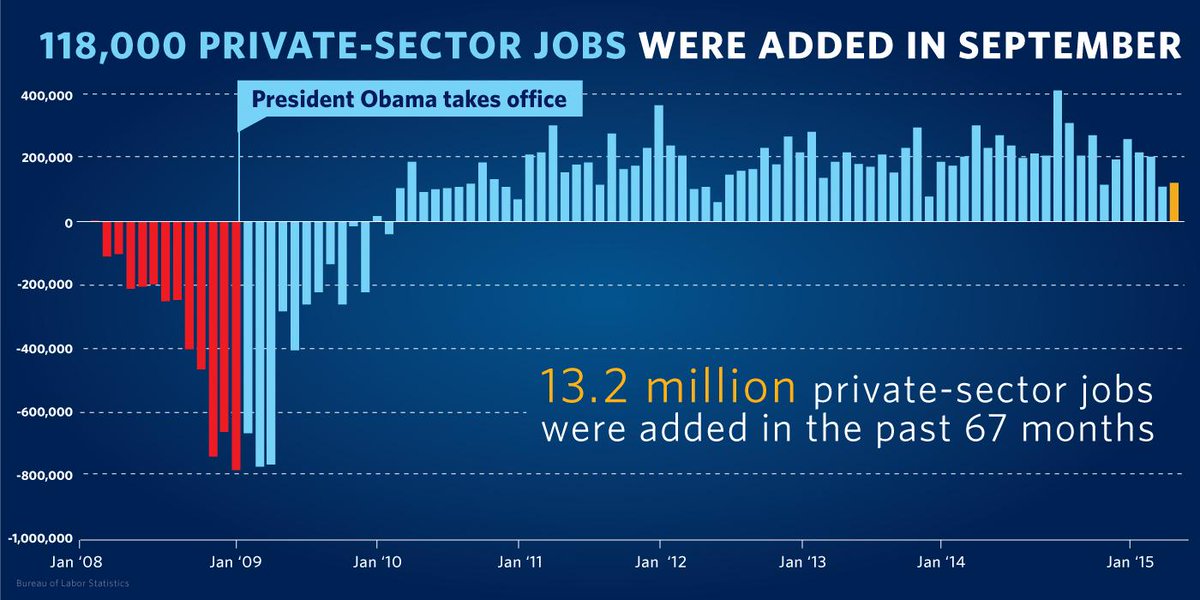

Further, with respect to the crucial question of job growth, President Obama's policies led to more than 14 million new jobs since the depths of the crisis of 2008. Even a cursory look at job growth in the USA since the Bush Administration (see chart below) proves that the GOP led the economy to the greatest job destruction in modern history. According to the Wall Street Journal, George W. Bush had the worst job creation record since WWII. President Obama quickly turned around the massive job losses he inherited, and has now presided over 70 straight months of job growth.

And, the most recent jobs report from the US Department of Labor is perhaps one of the best yet. Wages were up. The employment ratio was up. The US is now creating more jobs than at any other time since the last Clinton years.

Certainly, more job growth would be better, particularly for the middle class. Inequality is also a major barrier to continued economic growth. Economic weakness across the world further hinders US export growth. Global growth in turn would lead to more impressive job growth.These topics warrant separate posts, for another day.

Certainly, more job growth would be better, particularly for the middle class. Inequality is also a major barrier to continued economic growth. Economic weakness across the world further hinders US export growth. Global growth in turn would lead to more impressive job growth.These topics warrant separate posts, for another day.The key point for this post is that after a devastating economic collapse in 2008, after 8 years of GOP control, the US economy has achieved the most impressive economic recovery among developed nations. The entire developed world suffered a massive heart attack in 2008, and faced a total financial collapse; the US recovered the fastest and has enjoyed the most growth since the crisis.

The charts herein and the facts cited above show beyond dispute that the USA outperformed the entire world after the GOP trashed the economy the last time they controlled the government. After 8 years of GOP leadership, the US economy cratered in 2008, losing over 800,000 jobs per month. It now produces hundreds of thousands of jobs per month, month after month.

What particular policies led to this historic turnaround?

The OECD attributes the US recovery to government policies, including Obama's stimulus bill and financial stability, secured by the Dodd-Frank Act. Indeed, the OECD finds that:

Efforts to raise further capital requirements for large financial institutions, reduce fragmentation among regulators, and introduce macro-prudential tools is justified. In this respect, full implementation of Basel III and the Dodd-Frank Act is critical.

Efforts to raise further capital requirements for large financial institutions, reduce fragmentation among regulators, and introduce macro-prudential tools is justified. In this respect, full implementation of Basel III and the Dodd-Frank Act is critical.

I have previously criticized the Dodd-Frank Act for being incomplete, too weak, and too pro-banker. That is why I agree with Hillary Clinton and the experts at the OECD that it should be fully implemented and expanded. After all, the American economy outperformed the entire developed world after the financial crisis while Dodd-Frank became law and regulators implemented its mandates.

Yet, Trump wants to go the opposite direction. Trump quite clearly wants to "rip up" Dodd-Frank and return to the 2008 pre-Dodd-Frank legal and regulatory reality that spawned the Great Financial Crisis. This is the key difference between Trump and Clinton on the issue of bank regulation according to the Wall Street Journal. Indeed, Trump has already met with congressional leaders to plot the repeal of Dodd-Frank, suggesting that unlike most of his other crazy ideas he is quite serious about returning to the dark days of later 2008.

But given the impressive and successful performance of the US economy after the Great Financial Crisis of 2008, it just makes no sense to return to the same legal and regulatory reality that spawned that crisis. Why even roll the dice? If the gamble goes wrong (as so many Trump gambles do) it could mean mass unemployment like that which occurred prior to the inauguration of President Obama.

What particular policies led to this historic turnaround?

The OECD attributes the US recovery to government policies, including Obama's stimulus bill and financial stability, secured by the Dodd-Frank Act. Indeed, the OECD finds that:

Efforts to raise further capital requirements for large financial institutions, reduce fragmentation among regulators, and introduce macro-prudential tools is justified. In this respect, full implementation of Basel III and the Dodd-Frank Act is critical.

Efforts to raise further capital requirements for large financial institutions, reduce fragmentation among regulators, and introduce macro-prudential tools is justified. In this respect, full implementation of Basel III and the Dodd-Frank Act is critical.I have previously criticized the Dodd-Frank Act for being incomplete, too weak, and too pro-banker. That is why I agree with Hillary Clinton and the experts at the OECD that it should be fully implemented and expanded. After all, the American economy outperformed the entire developed world after the financial crisis while Dodd-Frank became law and regulators implemented its mandates.

Yet, Trump wants to go the opposite direction. Trump quite clearly wants to "rip up" Dodd-Frank and return to the 2008 pre-Dodd-Frank legal and regulatory reality that spawned the Great Financial Crisis. This is the key difference between Trump and Clinton on the issue of bank regulation according to the Wall Street Journal. Indeed, Trump has already met with congressional leaders to plot the repeal of Dodd-Frank, suggesting that unlike most of his other crazy ideas he is quite serious about returning to the dark days of later 2008.

But given the impressive and successful performance of the US economy after the Great Financial Crisis of 2008, it just makes no sense to return to the same legal and regulatory reality that spawned that crisis. Why even roll the dice? If the gamble goes wrong (as so many Trump gambles do) it could mean mass unemployment like that which occurred prior to the inauguration of President Obama.

Subscribe to:

Comments (Atom)